Business success is based on income and you’ll need funding to drive your operations if you want to generate more income. Entrepreneurs like you can use the following numbers as insight to begin your working capital funding research. Being aware of these facts can give you a leg up on securing business funds because you’ll know what to expect.

Here are 46 statistics for small businesses seeking working capital based on the latest annual reports and surveys from the US Federal Reserve, Small Business Administration, PwC, and other leading financial sources.

Business Lending Statistics

- Merchant cash advances and auto/equipment loans have the highest approval rates of any type of lending (Federal Reserve).

- In 2017, 6.1 million loans of less than $100K were issued to businesses in the United States (SBA).

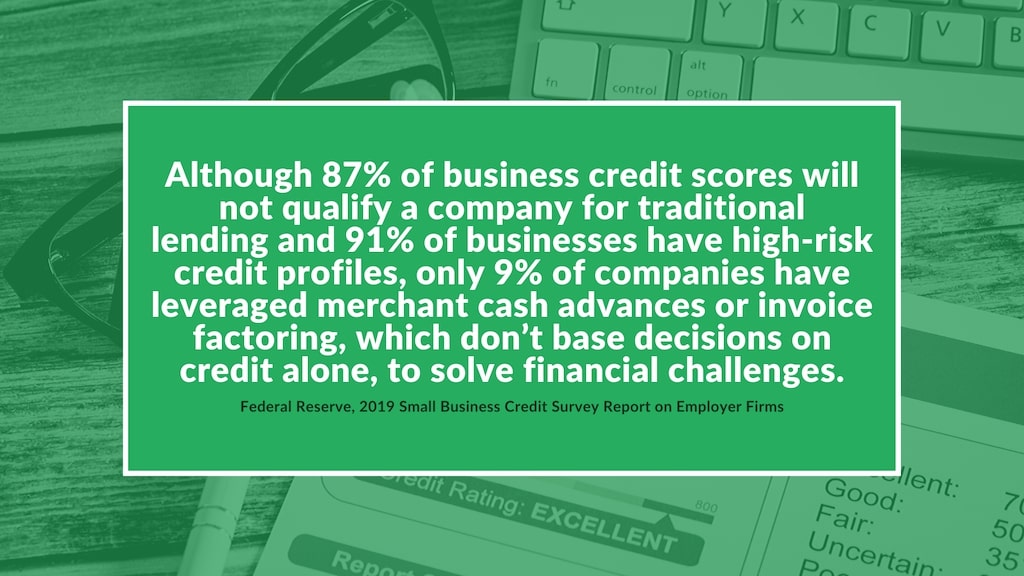

- 91% of all businesses have high-risk credit profiles (Federal Reserve).

- 55% of businesses take out loans or lines of credit when faced with financial challenges, which is the top lending choice for companies (Federal Reserve).

- 52% of businesses used credit cards when faced with financial challenges (Federal Reserve).

- 45% of companies leverage lending to address financial challenges (Federal Reserve).

- 32% of businesses seeking funding used online lenders in 2018, up from 24% in 2017 and 19% in 2016 (Federal Reserve).

- Although 87% of business credit scores will not qualify a company for traditional lending, only 9% of companies have leveraged merchant cash advances or invoice factoring, which don’t base decisions on credit alone, to solve financial challenges (Federal Reserve).

- 29% of business funding is used to purchase new equipment (Babson).

- Online business lending service funding was expected to reach $490 billion by 2020 (Kauffman).

- Entrepreneurs with home equity and personal credit cards are more likely to qualify for funding through traditional financial services (Kauffman).

Working Capital Statistics

- 54% of companies that secure some or all of the funding they apply for put the money toward improving cash flow, organizing working capital, and enhancing daily operations (Babson).

- 40% of companies struggle to pay operating expenses, which is the top financial challenge for businesses (Federal Reserve).

- 31% of businesses struggle with credit availability to pay for operating expenses (Federal Reserve).

- 27% of companies cite debt repayment as their biggest cash flow challenge, and adverse debt keeps 25% of businesses from seeking working capital (Federal Reserve).

- 17% of businesses report challenges with purchasing inventory or supplies to fulfill their contracts (Federal Reserve).

- While global business revenues are up 10% from 2018, operating cash flows have declined (PwC).

- Global working capital has increased by 9.4% since 2017 (PwC).

- Overall, there has been a 3.8-day decrease in business’ days payable outstanding since 2017 (PwC).

- A lack of business access to working capital can lead to canceled investments in technology and equipment, reduced employee pay or downsizing, and contribute to national unemployment (Babson).

Business Startup Statistics

- 90% of businesses with paid employees need startup financing at the time of launch (Kauffman).

- 83% of entrepreneurs do not apply for bank loans or venture capital at the time of launch (Kauffman).

- 64.4% of startups rely on personal and family savings to launch a business (Kauffman).

- 63% of startup firms’ credit profiles put them at high risk for traditional lending (Federal Reserve).

- 39% of global venture capital was allotted to US startups (Crunchbase).

- Men use about 33% more startup capital than women (Kauffman).

- 32% of startups report outstanding debt (Kauffman).

- Startup firms in the first five years of business are 14% more likely to add new employees than businesses that are six years old or older (Federal Reserve).

Business Revenue Growth Statistics

- Small business makes up 99% of companies and 50% of employers in the United States (Babson).

- Firms that raise their prices are 200% more likely to experience profit growth than those that do not (Federal Reserve).

- 57% of small businesses reported growth in 2018 (Federal Reserve).

- Funded companies achieve 50% more employment growth and 30% more revenue growth than businesses that received no money at launch (Kauffman).

- 42% of businesses are profitable (Federal Reserve).

- Only 38% of employer firms expected to add new payroll jobs in 2019, down from 43% in 2018 (Federal Reserve).

- 36% of businesses report no challenges paying for operating expenses (Federal Reserve)

- 31% of employer firms are growing (Federal Reserve).

- 9.5% of businesses with a lack of access to startup capital cited that this had a negative impact on profits (Kauffman).

Business Failure Statistics

- Access to capital is the number one concern that small businesses face (Babson).

- 70% of employer firms have outstanding debt (Federal Reserve).

- 67% of businesses do not turn a profit (Federal Reserve).

- When faced with financial challenges, more than 66% of employers used the company owner’s personal funds to solve the problem (Federal Reserve).

- Nearly 50% of businesses who apply but do not receive funding report difficulty expanding into new markets (Babson).

- 32% of businesses cut staff or hours or downsize operations when faced with financial challenges (Federal Reserve).

- 28% of companies have made late payments on operating expenses and debts when faced with financial challenges (Federal Reserve).

- Only 20% of businesses use their own profits to solve financial challenges (Federal Reserve).

- 2% of employer firms plan to close or sell (Federal Reserve).

Final Thoughts

Ample working capital can have a positive impact on your business profits. However, if you don’t qualify for traditional funding, you will have to look elsewhere. Even though a majority of companies haven’t leveraged alternative funding products like merchant cash advances or invoice factoring to maintain cash flow, they provide a convenient solution for working capital struggles.

Get to know about more of your working capital financing options and stay on track with your company growth.

[Learn About Working Capital Financing]

Sources

Federal Reserve 2019 Small Business Credit Survey Report on Employer Firms: https://www.fedsmallbusiness.org/medialibrary/fedsmallbusiness/files/2019/sbcs-employer-firms-report.pdf

Ewing Marion Kauffman Foundation 2019 Capital Report:

Crunchbase, The Q4/EOY 2019 Global VC Report: A Strong End To A Good, But Not Fantastic, Year

PwC, 2019/20 Working Capital Report

SBA, 2019 Small Business Profile Report

https://cdn.advocacy.sba.gov/wp-content/uploads/2019/04/23142719/2019-Small-Business-Profiles-US.pdf

Babson, 2019 Voice of Small Business in America Insights Report

https://www.goldmansachs.com/citizenship/10000-small-businesses/US/2019-insights-report/report.pdf