Lendr knows small business

The fast track to working capital. Get up to $250k in as little as 24 hours

Financial solutions for your small business

We offer two main products to help grow your businesses. Merchant Cash Advances for when you need a little extra working capital, or Invoice Factoring when you want invoices paid today. Tap on a product to learn more or give us a call at (888) 887-2812.

Merchant Cash Advance

Is a merchant cash advance right for me?

Our Super Simple Process

Apply Online

Get an offer or submit your invoices in under 5 minutes for up to $500k. Not ready to apply? Scroll down to try out our offer calculator.

Provide Documents

Some examples include your business license, current financial and a bank verification. No printer required.

Get an Offer

Get an offer in less than 2 hours, and have funds in your bank account in as little as 24. Apply today and let’s get back to work.

The numbers speak for themselves

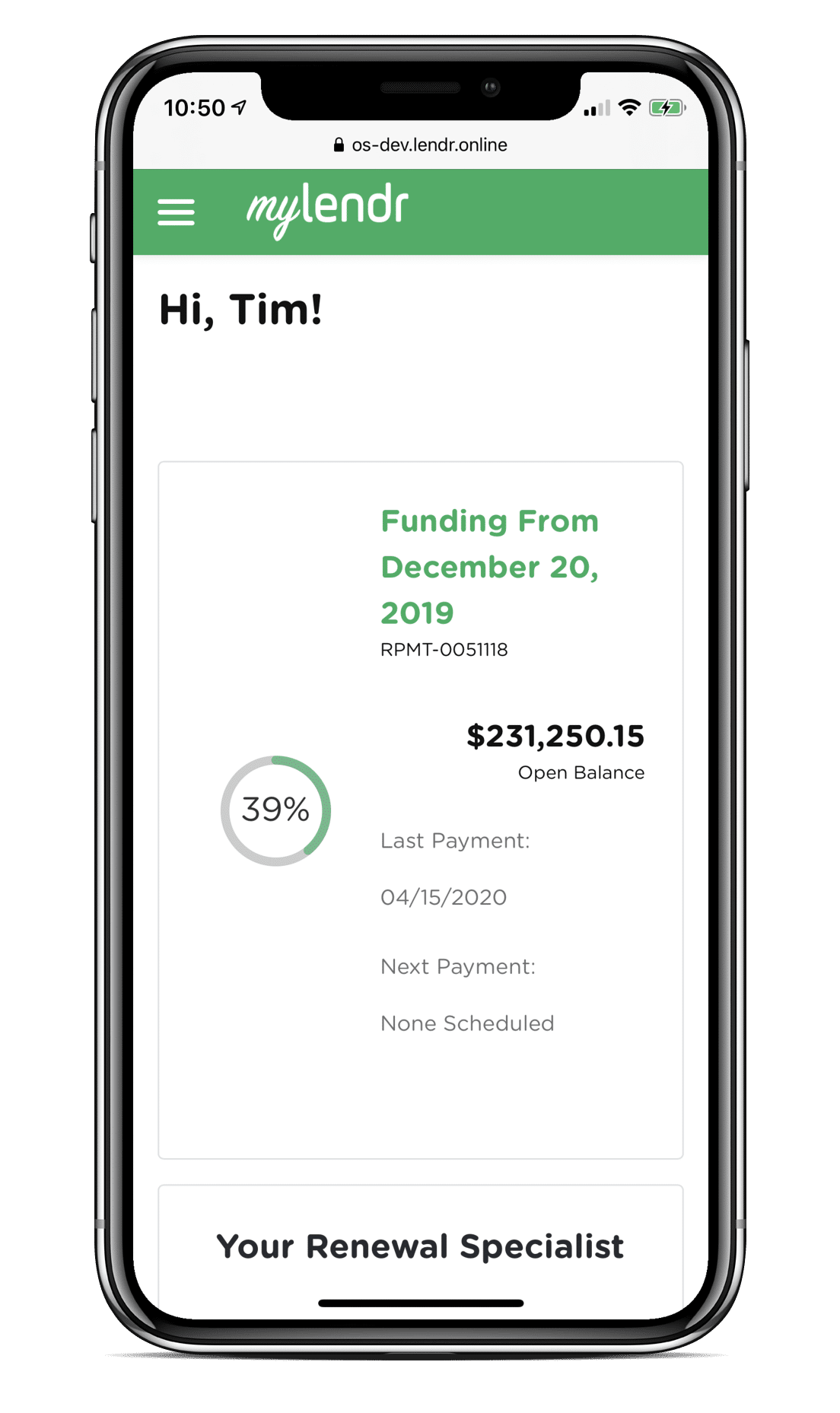

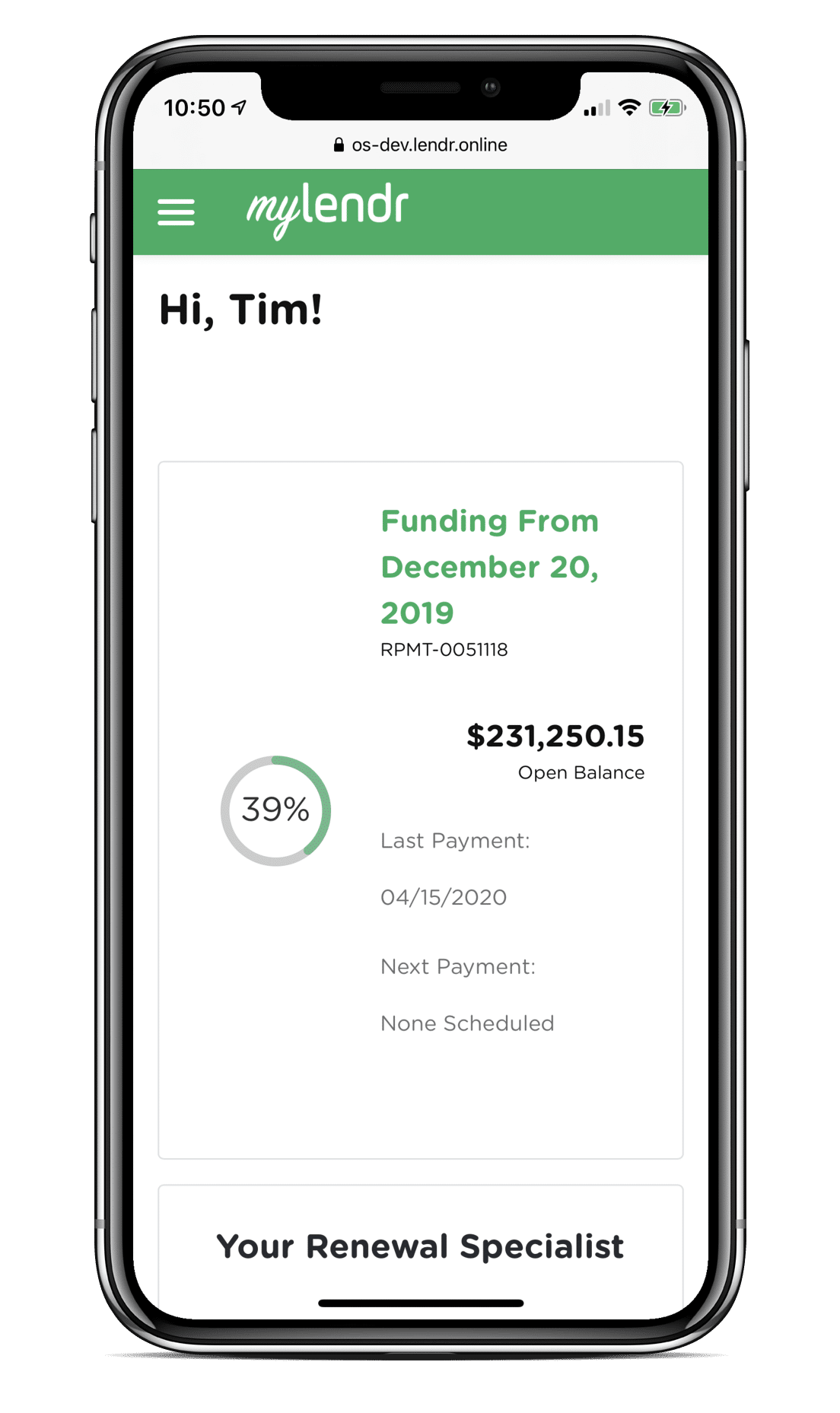

The all new myLendr

Check your balance

See what you owe, your next remittance and when you're eligible for renewal funding opportunites.

Customize your offer

Choose your own offer, customize your turn, rate, and total funding amount. It's like mix and match, but for money.

Connect with your rep

We will connect you directly to your rep - no phone banks or hold music. You can even chat us directly.

Apply Online

Apply online in minutes. Most customers need just 10 minutes to apply, and most have an offer in just 2 hours.

Renew in a snap

Business is great? A little extra cash can help you grow to the next level! A renewal puts that cash in your account.

All your documents

Grab a payoff, zero-balance letter, or remittance statement right in the portal. Download your documents securely in PDF format.

Get started today

Working Capital

Up to $500k

in less than 48 hours

- Offer in as little as 2 hours

- Fixed daily payment

- Next day funding

- No effect on credit score

Invoice Factoring

Up to $1m

on outstanding invoices

- Up to 100% of invoice value

- Client invoicing support

- Full-service financing available

- Flexible contract terms